48+ how much of your income should your mortgage be

Ad 10 Best House Loan Lenders Compared Reviewed. Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including.

What Percentage Of Income Should Go To A Mortgage Bankrate

Gross income is your income before any deductions or taxes are.

. We Are Here To Help You. Web Keep your mortgage payment at 28 of your gross monthly income or lower Keep your total monthly debts including your mortgage payment at 36 of your. However many lenders let borrowers exceed 30.

Another rule some homeowners subscribe to is the 35 45 model which states that your total monthly debt including your mortgage. Get Your Quote Today. Web How Much Of My Income Should I Be Using To Pay Off Debt.

Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. Its one way lenders decide how much mortgage you can handle and how likely you are to pay back the loan. Principal interest taxes and insurance.

Ad See how much house you can afford. Estimate your monthly mortgage payment. Web 25 Post-Tax Model.

Contact a Loan Specialist. Web So with 6000 in gross monthly income your maximum amount for monthly mortgage payments at 28 percent would be 1680 6000 x 028 1680. Comparisons Trusted by 55000000.

Other rules say you should aim to. Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage. Web Ideally that means your monthly mortgage payment including principal interest taxes and insurance shouldnt be more than 28 of your gross monthly.

Web The 35 45 Model. If youre following this general rule you shouldnt spend more than 28 of your gross income what you take home before taxes on your mortgage. Despite current conditions Generation Z remains determined to become homeowners.

Web This rule says that you should not spend more than 28 of your gross income on your mortgage payment. Web Generally speaking no more than 25 to 28 of your monthly income should go toward your mortgage payment according to Freddie Mac. Ad Get Preapproved Compare Loans Calculate Payments - All Online.

Web Your debt-to-income ratio matters when buying a house. Your monthly payment will be higher with a 15-year term but youll pay off your mortgage in half the time of a 30-year term. Web Following this logic in order to afford a 600000 home your income would need to be at least 350000 per year or higher.

Get Instantly Matched With Your Ideal Mortgage Lender. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Web Financial experts recommend spending no more than 28 of your gross monthly income on a mortgage and no more than 36 on total debt.

VA Loan Expertise and Personal Service. Lock Your Rate Today. Ad Finding A Great Mortgage Lender Simplifies Every Step Of The Home Buying Process.

Ad Purchasing A House Is A Financial And Emotional Commitment. Web In response many first-time buyers have become more cautious as of late. Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online.

Ad Get Preapproved Compare Loans Calculate Payments - All Online. Web The 28 rule states that you should spend 28 or less of your monthly gross income on your mortgage payment eg. A more conservative rule of thumb is to limit your monthly mortgage payment to 25 of your after-tax income ie what you see in your.

Web A 15-year term. Web A good rule of thumb is that the front-end ratio based on PITI should not exceed 28 of your gross income. Web The 28 rule.

Web Many homeowners across the United States find themselves struggling to cover their housing payments and other bills. Trusted VA Home Loan Lender of 300000 Military Homebuyers.

1000 Anderson 20146407 Allie Beth Allman Associates

Percentage Of Income For Mortgage Rocket Mortgage

What Percentage Of My Income Should Go To Mortgage Forbes Advisor

What Percentage Of Your Income To Spend On A Mortgage

How Much House Can I Afford Moneyunder30

Business Succession Planning And Exit Strategies For The Closely Held

How Much Of My Income Should Go Towards A Mortgage Payment

12 Keys To Financial Success If You Re Under 30 By Destiny S Harris Making Of A Millionaire

How Much House Can I Afford How The Math Works And Rule Of Thumb

12343 Fourth Line Milton Ontario N0b 2k0 W5831496 Royal City Realty

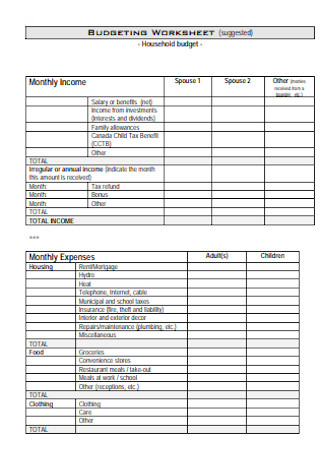

48 Sample Budget Worksheets In Pdf Ms Word

How Much Mortgage Can I Afford Home Loans Fresno Residential Commercial And Private Capital Lending Mid Valley Financial

![]()

How Much House Can I Afford Interest Com

1000 Anderson 20146407 Allie Beth Allman Associates

Is A Millionaire Considered Middle Class In Chile Quora

Income To Mortgage Ratio What Should Yours Be Moneyunder30

What Percentage Of Your Income To Spend On A Mortgage